tax on unrealized gains yellen

Total long term capital gain rate 567. Billionaire Investor fires back after Yellen says shed consider taxing unrealized capital gains.

Janet Yellen Not Planning A Wealth Tax But Could Do Capital Gains Tax

Treasury Secretary Yellen proposes a tax on unrealized capital gains to finance Bidens Build Back Better plans.

. Billionaire investor Howard Marks was highly critical of Biden Treasury Secretary nominee Janet Yellen for saying shed consider taxing unrealized capital gains. A Texas resident would see the following taxes. Lawmakers are considering taxing unrealized capital gains.

Ron Wyden D-Oregon would impose an annual. Secretary of the. BeInCrypto The United States Treasury Secretary Janet Yellen has announced the proposal of a new tax that could hit unrealized capital gains.

Instead of paying taxes when you finally sell your home or cash out your 401k or trade stock you would be taxed on the subjective made-up unrealized value gain right now. The Wyden plan by contrast would tax only the unrealized gain. Is exploring plans to tax unrealized capital gains sparking fierce criticism on Crypto Twitter.

Reuters January 19 2021. Treasury Secretary Janet Yellen explained on CNN Sunday that the proposal raised by Sen. Political Commentators Libertarians Crypto Enthusiasts Scorn Yellens Proposal Tax on Unrealized Gains Is Legal Plunder The 2020 Libertarian vice presidential candidate Spike Cohen said This is unconscionable.

24 2021 125 pm ET. Government coffers during a virtual conference hosted by The New York Times. Taxing unrealized capital gains also known as mark-to-market taxation What is an unrealized capital gain.

Since then many wealth managers from Howard Marks to Peter Mallouk as well as many others have argued that this. Bidens newly appointed US. Unrealized capital gains put simply is the increase in the value of an asset that has yet to be sold.

January 26 2021 1013 am. Yellen made the remarks in response to a question from Tapper about whether a wealth tax should be part of how Democrats look to pay for Bidens 35 trillion. A 2 drawdawn on your unrealized capital gains requires people to have set aside cash for that very tax purpose.

Yellen argued that capital gains are an extraordinarily large part of the. An unrealized gain is when something you own gains value but you dont sell it like your house or your retirement fund. President Biden Unveils Unrealized Capital Gains Tax for Billionaires.

Treasury Secretary Janet Yellen told CNNs Jake Tapper on Sunday that Senate Democrats are considering a proposal to impose a tax on unrealized capital gains of the wealthiest Americans. That sounds good until you realize that 100000 increase was an unrealized gain. Treasury Secretary Janet Yellen is currently considering some shocking policies.

Senator Warren advocated a 3 percent tax for billionaires for example. Janet Yellens Preposterous Tax Plan. Marks who is co-chairman and co-founder of Oaktree Capital said I.

At a time when there. Earlier in 2021 Yellen proposed taxing unrealized capital gains to boost US. Political Commentators Libertarians Crypto Enthusiasts Scorn Yellens Proposal Tax on Unrealized Gains Is Legal Plunder The 2020 Libertarian vice presidential candidate Spike Cohen said This is unconscionable.

24 2021 626 pm ET Original Oct. For those who dont know an unrealized gain is when something you own gains value but you dont sell it. It goes against the concept of taxing income because thats a tax on generated cash flow whereas there is no generated cashflow in.

National Investment Income Tax 38. And if you dont pony up for Janet Yellens salary the government is coming for you. Capital gains tax is a tax on the profit that investors realize on the sale.

Speaking to CNN on Sunday the former Federal Reserve chair said the measures would target liquid assets held by extremely wealthy individuals. Yellen Describes How Proposed Billionaire Tax Would Work. For those who dont know an unrealized gain is when something you own gains value but you dont sell it.

Treasury Secretary Janet Yellen has revealed that the US. Disclosetv disclosetv October 24 2021. Yellen had first proposed the tax on unrealised capital gains in February 2021.

Federal long term capital gain rate 396 BidenYellen proposal v 20 today. Janet Yellen the Treasury Secretary in the Joe Biden administration has proposed taxing unrealised capital gains. Yellen told Jake Tapper I think whats under consideration is a proposal that Senator Wyden and the Senate Finance Committee have been looking at that would impose a tax on unrealized.

Secretary Janet Yellen has been discussing in various media the Biden administration is now revealing an unrealized capital gains tax from stocks and bonds. The eyebrows of some senators and Wall Street when she said that the Treasury would consider the possibility of taxing unrealized capital gains through a mark-to-market mechanism as well as other approaches to boost revenues. Yellen wants investors to pay a tax on the increase in value of their stock every year even if it isnt sold.

The plan will be included in the Democrats US 2 trillion reconciliation bill. California long term capital gain rate 133. Janet Yellen the Treasury Secretary in the Joe Biden administration has proposed a tax on unrealized capital gains.

NEW US. The 78th United States secretary of the treasury Janet Yellen told CNNs State of the Union on Sunday that US. Janet Yellen Bidens nominee for Treasury Secretary said she would consider taxing such unrealized gains to boost government revenues reported Reuters.

VIDEO 1521 1521 Howard Marks of Oaktree. Federal long term capital gain rate 396 BidenYellen proposal v 20 today.

Yellen Describes How Proposed Billionaire Tax Would Work Including Yellen S Proposed Tax On Unrealized Gains In The Stock And Real Estate Market R Wallstreetbets

Bloombergquint On Twitter Yes Taxation Of Unrealised Stock Market Gains Seems Unusual But It Is Already Embedded In The System Argues Shankkaraiyar Calling For A One Time Tax On Billionaires He Points To

Nancy Pelosi Portfolio Tracker Nancytracker U S Treasury Secretary Yellen Proposes A Tax On Unrealized Capital Gains To Finance Biden S Build Back Better Plans This Is Disgusting Fate Ron The Hill

Breaking Treasury Secretary Yellen Is Calling For An Unrealized Gains Tax This Is Unconscionable For Those

Treasury Secretary Janet Yellen Says Taxing Unrealized Capital Gains Is A Possibility Youtube

Janet Yellen S Idea To Tax Steal Unrealized Capital Gains Spike Cohen Calls It An Act Of War Against The Middle Class R Libertarian

Janet Yellen S Proposal For A Capital Gains Tax In Us May Push Global Money Towards Markets Like India Business Insider India

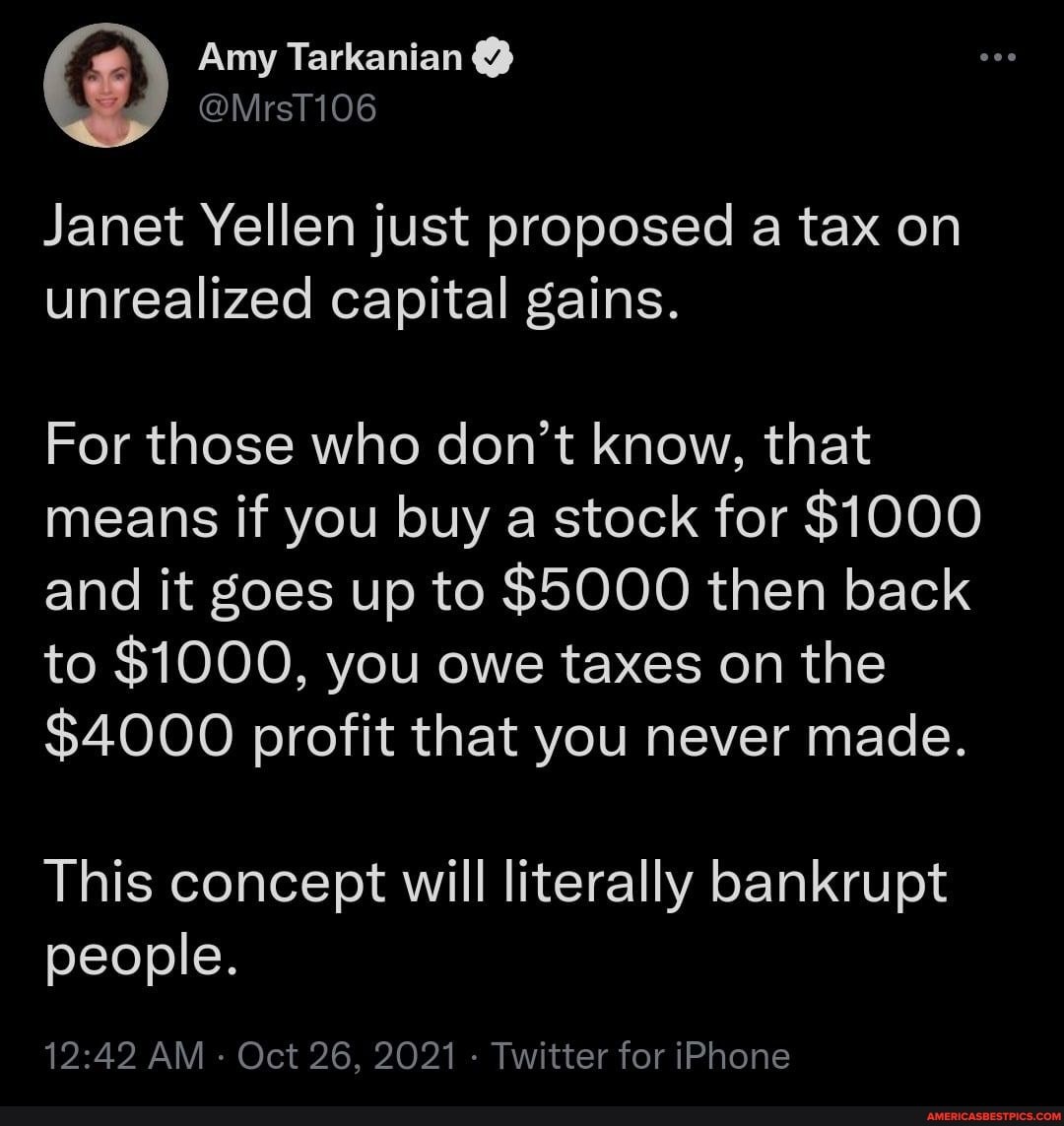

Janet Yellen Just Proposed A Tax On Unrealized Capital Gains For Those Who Don T Know

Janet Yellen May Give Us Bitcoin Investors Tax Shock Somag News